If you’re preparing to sell a home and that home is located in or near a flood-prone area, then understanding flood insurance requirements isn’t just helpful – it’s essential. Buyers, lenders, and agents will ask the right questions, and as a seller, you want to have the right answers. This includes knowing flood zone designations, how the National Flood Insurance Program (NFIP) affects your obligations, and more importantly, what is exempt from flood insurance requirements. At this stage, a lack of preparation can stall negotiations, raise red flags, or reduce the perceived value of your property.

Flood insurance for sellers can seem like yet another layer of complication in the selling process, but it doesn’t have to be. With the right approach, the right knowledge, and the right representation, you can manage flood-related disclosures and requirements effectively. Let me guide you through the essentials, while also introducing how my role as Broker and REALTOR at Uncommon Realty makes all the difference.

TL;DR: Flood Insurance for Sellers: What You Need to Know and Why It Matters

- Sellers in flood-prone areas need to understand the nuances of flood insurance to protect their transactions.

- Many properties may be exempt, and knowing what is exempt from flood insurance requirements can be a key advantage.

- Federal legislation, such as the NFIP, heavily influences what sellers must disclose and prepare for.

- Expert guidance from Robbie English and his team can ensure you’re not caught off guard.

- With decades of experience, Robbie helps sellers navigate requirements, reduce surprises, and protect their bottom line.

Understanding the Role of Flood Insurance in the Sale Process

When a buyer is financing a property, their lender will scrutinize every potential risk to the home, and flooding is one of the most severe. Standard homeowners insurance doesn’t cover it. This means that if a home is in a special flood hazard area (SFHA), then flood insurance may be required by the lender. And if it is required, it has to be in place before the loan can close.

But what about you, the seller? You may not need to purchase new coverage, but you do need to disclose. A proactive seller will gather this documentation ahead of time. If you already have a flood insurance policy in place, it may be transferable to the buyer, which can be a selling point. If not, it’s critical to know whether your property falls under the floodplain and what the implications are.

Flood Insurance for Sellers: A Strategic Mindset

Here’s where the opportunity lies. Flood insurance for sellers is not just about compliance; it’s about strategy. With early identification of the flood zone status, you can:

- Accurately price your home.

- Prevent buyer hesitations.

- Prepare disclosures in advance.

- Avoid last-minute closing delays.

I don’t approach these matters lightly. As a national real estate instructor and speaker, I’ve taught agents across the country about exactly this kind of nuance. Flood zones vary, maps change, and legislation evolves. Working with someone like me, who understands how to interpret those changes and adjust the transaction accordingly, can make the difference between a closing and a cancellation.

The National Flood Insurance Program (NFIP) and You

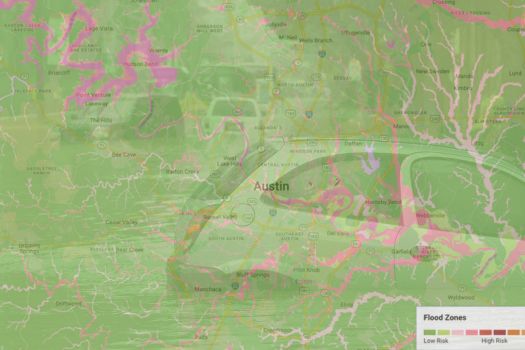

Administered by FEMA, the National Flood Insurance Program (NFIP) sets the tone for flood-related requirements. Not all properties are subject to the same level of scrutiny. FEMA classifies flood risk areas and publishes flood insurance rate maps (FIRMs) that indicate which properties fall into special flood hazard areas.

If your home is in one of these areas, it may trigger a flood insurance requirement during the sale process. But there are exceptions, and knowing what is exempt from flood insurance requirements can give you a leg up when preparing to list your property.

For example, a property may be located near a flood zone, but not within it. Or a Letter of Map Amendment (LOMA) may have been filed to remove a property from a high-risk area. These are details many sellers overlook, but they’re details I dig into.

Legislative Impacts on Sellers

Flood insurance isn’t just shaped by nature – it’s shaped by Washington. Federal acts like the Biggert-Waters Flood Insurance Reform Act and the Homeowner Flood Insurance Affordability Act have restructured how insurance premiums are calculated and phased in. What used to be simple has gotten complex.

For sellers, this means the premiums on a current flood insurance policy might not reflect what a buyer would pay. It depends on subsidies, elevation certifications, and flood zone reclassifications. As your agent, I help identify whether there are any rate shocks looming for potential buyers so we can proactively address concerns.

With each legislative shift, flood risk assessments change, and more areas may be brought into flood zones, triggering new requirements. Staying ahead of this, especially if your area is under review for map updates, is crucial. This is not a guessing game – this is a detail-driven process that demands clarity.

What is Exempt from Flood Insurance Requirements?

Not every property needs flood insurance. Understanding what is exempt from flood insurance requirements could directly influence how you market and negotiate the sale of your property.

Some of the most common exemptions include:

- Properties purchased without a federally backed mortgage.

- Homes located in zones classified as minimal or moderate risk.

- Instances where a LOMA has removed a property from a high-risk designation.

By identifying whether a property falls into an exemption category, sellers can improve their listing strategy and ease buyer apprehensions. This isn’t just about removing an obstacle; it’s about creating leverage.

Helping You Navigate with Precision

With decades of real estate experience, I’ve learned that the best sellers don’t just react to buyer questions – they anticipate them. That’s why I approach each listing with a thorough understanding of how insurance issues, including flood insurance, will play into the transaction.

When you list with me, you’re not getting surface-level service. You’re getting expert-level insight. I scrutinize FIRMs, consult historical flood data, and work closely with your insurance provider to clarify the property’s flood-related profile. That information allows us to prepare the listing accurately, disclose proactively, and eliminate room for renegotiation later in the process.

Other agents may hand off the flood zone question to the buyer’s lender or insurance rep. I don’t. I take ownership of it so we can be in control of the narrative from the start.

The Real Impact on Your Bottom Line

Buyers hesitate when they see unknowns. If a property is in a flood zone but the details aren’t clear, that uncertainty becomes a liability. Buyers may offer less, ask for concessions, or walk away entirely.

On the other hand, clear documentation and guidance eliminate guesswork. When buyers understand the current flood insurance coverage, the potential for transfer, and whether exemptions apply, they feel secure. And secure buyers make better offers.

So, flood insurance for sellers isn’t just paperwork – it’s a negotiating tool. And I’ll help you use it.

A Step Ahead with Robbie English

I didn’t stumble into this knowledge. I built it. Over decades, I’ve worked to master real estate not just as a practitioner, but as an educator and strategist. I teach agents nationwide about the complexities of flood zones, insurance disclosure, and contract negotiation because I believe real estate professionals should lead from the front.

This benefits you directly. As your listing agent, I bring that same level of insight and preparation to your transaction. I break down the requirements, identify exemptions when they exist, and present your property with confidence and clarity. This ensures smoother negotiations and helps you retain more control over the sale.

Don’t Rely on Guesswork. Rely on Expertise.

Too often, sellers enter the market thinking they’ll deal with insurance issues later. But “later” in real estate usually means “too late.” When surprises surface late in the process, they create anxiety and delay. That’s why my team and I bring these issues to the forefront from the beginning.

We ask the right questions. We uncover the right data. We build a strategy that shields you from surprises.

Flood insurance for sellers doesn’t have to be confusing. You just need a guide who understands the process from every angle. Let’s put my experience to work for you, so we can keep your sale on track and maximize your returns.

Because when you’re working with Robbie English with Uncommon Realty, you’re not just checking boxes. You’re winning.

Leave a Reply