Do you know how much your house is really worth? It’s one of those questions every homeowner should ask, yet most don’t check the answer often enough. Many people have their cars inspected annually and their credit reviewed regularly, but the value of their home, their single greatest financial asset, often goes unexamined for years. That’s a mistake that could cost you money or opportunity.

I’m Robbie English, Broker and REALTOR at Uncommon Realty, and I’ve spent decades helping people just like you understand the true power hidden within their homes. My goal isn’t just to tell you what your home might sell for. It’s to show you how your property fits into your larger financial picture, how your equity can work for you, and how you can strategically use that information to make your next move with confidence.

If you’ve lived in your home for several years, there’s a strong chance it’s been building wealth for you quietly in the background. Markets change, values fluctuate, and interest rates move, but one constant remains: real estate continues to be one of the most consistent creators of long-term wealth. Understanding where you stand today gives you the clarity to plan tomorrow.

TLDR: Do You Know How Much Your House Is Really Worth?

- Your home’s value changes more often than you think; knowing it empowers smarter decisions.

- Equity is the hidden wealth inside your property and can open major opportunities.

- Long-term ownership and price growth mean you may have more equity than you realize.

- Equity can fund your next home, renovations, or even your next business venture.

- Robbie English and Uncommon Realty provide expert equity assessments to help you move forward confidently.

Why Knowing Your Home’s Value Matters

Homeownership isn’t just about where you live; it’s about building financial stability. The value of your home impacts nearly every major financial decision you’ll make, from refinancing to retirement planning. If you’ve never had a professional assessment of your home’s worth outside of a purchase or sale, you’re overlooking a major piece of your financial puzzle.

Knowing your home’s true value puts you in control. It helps you determine when to sell, when to refinance, or when to invest in improvements. It also helps you understand your equity position, which can unlock new opportunities for your next chapter.

When I work with clients through Uncommon Realty, I approach this from both an emotional and financial perspective. Your home isn’t just a structure; it’s an evolving asset that should be managed strategically. That’s where my decades of experience come in. I’ve learned to look beyond the surface and into the numbers that tell your home’s real story.

Understanding the Concept of Equity

Equity is the bridge between where you are today and where you want to be tomorrow. Simply put, it’s the difference between what your house is worth right now and what you still owe on it. As you make mortgage payments, the balance decreases, and as the market appreciates, your value increases. The combination of the two creates equity—a kind of stored financial potential.

Imagine your home is valued at $500,000, and your remaining mortgage is $200,000. That means you have $300,000 in equity. That’s not just a number on paper. It represents money you’ve built over time through ownership, payments, and appreciation.

Many homeowners underestimate this value because they rely on generic online estimates that often miss critical details about condition, upgrades, or neighborhood trends. That’s why a personalized professional review by someone who understands your local market—like me—is so important. At Uncommon Realty, we go beyond algorithms to consider real factors that make your home unique.

Why You Might Have More Equity Than You Think

If you’ve owned your home for more than a few years, the odds are high that you’ve built more equity than you realize. Home values have risen dramatically over time, and the average homeowner has gained significant appreciation. But that’s only part of the story.

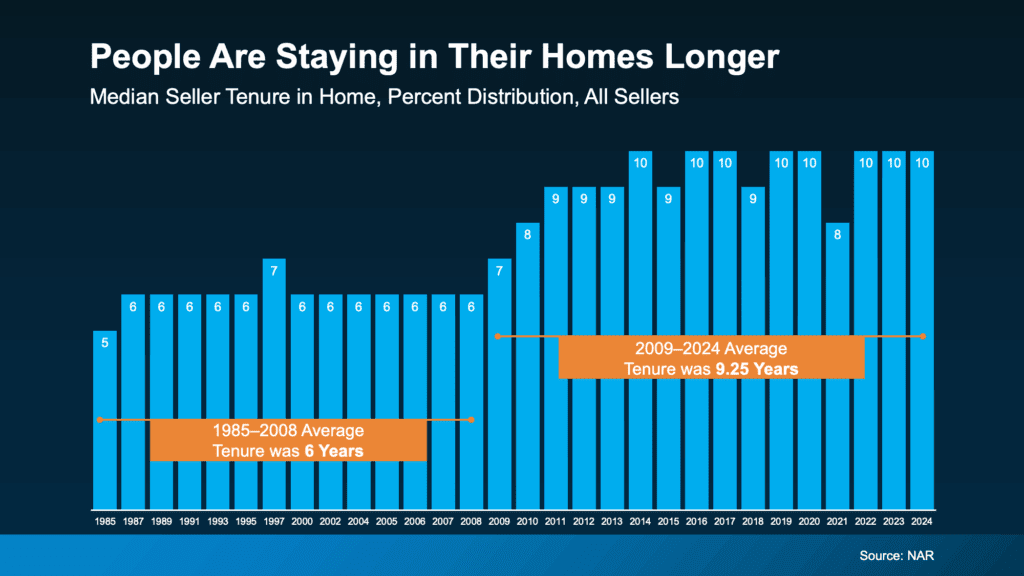

Another reason homeowners have more equity than expected is that people are staying in their homes longer. The longer you stay, the more payments you make, and the more you benefit from market appreciation. Ten years ago, moving every five years was common. Now, many homeowners remain for a decade or more, and that consistency compounds their financial position.

The takeaway is simple: your equity may have quietly transformed your home from a place of comfort into a significant financial tool. The question becomes how to use it wisely.

How Equity Can Work for You

Equity can serve as the foundation for your next great move. It’s flexible capital that can be leveraged in several ways. Whether you’re planning to sell, upgrade, or reinvent your space, your equity can help you do it strategically.

You might use it to purchase your next home. For many sellers, the proceeds from one property become the down payment for the next. With substantial equity, you may even buy your next home in cash or dramatically reduce your new loan amount.

You could also reinvest in your current home. Thoughtful renovations, like updating a kitchen or adding outdoor living space, can enhance both your daily life and future resale value. It’s not about flipping your home; it’s about strengthening an asset you already own.

And for the entrepreneurs out there, home equity can be the seed money that launches your next business idea. I’ve seen clients use their equity to fund ventures, secure investment properties, or start businesses that completely transformed their financial paths.

Whatever your goals, equity provides options—and knowing your home’s true worth is where that flexibility begins.

The Real Value of Professional Insight

Online tools can provide rough estimates, but they can’t interpret the subtleties of your neighborhood, your upgrades, or market timing. Automated systems don’t walk your property or understand how your street differs from the one next door.

When you work with me, you’re not just getting a number; you’re getting context. I evaluate the market based on current listings, closed sales, and private data points available to professionals. My years as a broker, instructor, and national real estate speaker allow me to identify pricing nuances that others overlook.

At Uncommon Realty, our process goes deeper. We analyze your home’s competitive position, factoring in condition, improvements, and buyer trends. Then we present you with a professional equity assessment, a document that gives you clarity about where you stand and how to move forward with confidence.

This isn’t about guessing your home’s price. It’s about giving you the insight to make informed decisions, whether that means selling now, refinancing, or holding for the future.

Why Choose Robbie English and Uncommon Realty

![]() Real estate expertise isn’t created overnight. It’s built through years of dedication, constant learning, and real-world results. I’ve spent decades mastering the art and science of real estate, not only as a practitioner but also as a teacher. I’m a national real estate speaker and instructor, training other agents across the country on how to serve their clients at the highest level. That depth of knowledge translates directly into better strategy for you.

Real estate expertise isn’t created overnight. It’s built through years of dedication, constant learning, and real-world results. I’ve spent decades mastering the art and science of real estate, not only as a practitioner but also as a teacher. I’m a national real estate speaker and instructor, training other agents across the country on how to serve their clients at the highest level. That depth of knowledge translates directly into better strategy for you.

When you work with me, you gain more than a broker—you gain a partner who understands how to interpret the market and anticipate shifts before they happen. Uncommon Realty was built on the idea that every client deserves tailored service, not templated solutions. My team and I provide expert guidance on everything from pricing to negotiation, ensuring that every move you make in real estate works toward your long-term advantage.

You could choose any agent, but few bring the combination of insight, teaching experience, and market intuition that I do. I don’t follow trends; I help set them. That’s what makes my approach truly uncommon.

Selling Smart: Using Knowledge as Leverage

If you’re thinking about selling, understanding your home’s real value gives you an undeniable advantage. Pricing too high can scare buyers away; pricing too low leaves money on the table. The right price captures attention, drives interest, and positions you for a smoother transaction.

My approach is both analytical and intuitive. I study local data, but I also understand buyer psychology. I know what motivates buyers in Austin, Cedar Park, Leander, and the Highland Lakes markets. That local expertise allows me to help you stand out among the competition.

By starting with a professional evaluation of your home’s value, we can craft a pricing strategy that draws serious buyers while maximizing your return. From staging advice to strategic marketing, every step is designed to get results that align with your goals.

Selling your home isn’t just a transaction—it’s a major financial decision. Partnering with someone who knows how to protect and enhance your equity ensures you walk away with confidence.

For Buyers: The Other Side of the Equation

If you’re looking to buy, understanding property values is just as important. Knowing what homes are truly worth allows you to make smarter offers and avoid overpaying. As a buyer, you need someone who can see value clearly, not just in numbers but in potential.

I help buyers evaluate homes not only for their current market value but also for their long-term return. That’s a skill that comes from years of studying real estate cycles and teaching negotiation strategies to agents nationwide. Whether you’re purchasing your first home or your fifth, having me in your corner ensures every decision supports your future equity growth.

At Uncommon Realty, we don’t just help people buy homes—we help them build wealth through real estate. Every purchase is a step in your financial story, and I’m here to make sure it’s a smart one.

How We Calculate Your Home’s Value

Our valuation process combines data, experience, and insight. We begin with an in-depth analysis of recent comparable sales, then we assess the unique features of your property—condition, upgrades, and neighborhood desirability. From there, I apply my expertise to interpret how those details affect real-world buyer perception and pricing power.

The result is a clear, accurate picture of your home’s position in today’s market. But we don’t stop there. I also review how your equity could support your next move, whether that means selling and upsizing, investing in income property, or simply planning for retirement.

This level of attention ensures you’re not just reacting to market conditions; you’re proactively shaping your financial path.

Making Your Equity Work for You

Once you understand your equity, the real fun begins. You can use it to create new opportunities—ones that might not have been possible without professional guidance.

Perhaps you want to move closer to work, buy a second property near the water, or downsize and free up capital. Your equity is the bridge that gets you there. I help clients strategically tap into that equity while minimizing risk and maximizing return.

We’ll talk about your goals, evaluate your timing, and design a plan that aligns with both the market and your financial comfort zone. My team handles every step with transparency, keeping you informed and in control from start to finish.

Why Expertise Matters More Than Ever

The real estate landscape shifts constantly. Interest rates move, buyer preferences evolve, and regulations change. Without expert interpretation, it’s easy to make decisions based on outdated information or emotion.

That’s where my experience becomes your advantage. As a broker and educator, I stay ahead of these shifts, teaching others how to interpret them and applying that same insight to my clients’ benefit. I don’t just react to the market—I understand the forces that shape it.

When you work with Uncommon Realty, you gain access to that level of expertise every step of the way. Whether we’re evaluating your current home or exploring your next opportunity, my role is to make sure you have every piece of information you need to act with confidence.

Do You Know How Much Your House Is Really Worth?

Now that you understand what’s at stake, it’s time to get your answer. Let’s find out exactly where you stand. I’ll personally prepare a professional equity assessment that breaks down your home’s current market value, your estimated equity, and your potential next steps.

This isn’t an automated guess or a one-size-fits-all report. It’s a tailored evaluation rooted in real experience and current market understanding. I’ll walk you through the findings, answer your questions, and help you determine the smartest ways to put your home’s value to work for you.

Your home has been working quietly in the background, building wealth while you live your life. Isn’t it time to find out just how much progress it’s made?

Take the Next Step with Robbie English

If you’re curious about your home’s true worth, I invite you to reach out to me directly. Together, we’ll uncover the real value of your property and chart a path that uses your equity strategically.

I’m Robbie English, Broker and REALTOR at Uncommon Realty, and my team and I are here to provide expert guidance for every stage of your real estate journey. Whether you’re selling, buying, or simply exploring your options, I bring decades of experience, teaching expertise, and market insight to every conversation.

When it comes to answering the question “Do You Know How Much Your House Is Really Worth?” I’m the one who can give you more than just a number. I’ll give you a strategy. Let’s connect today and start turning your home’s hidden value into your next big opportunity.

Leave a Reply