Georgetown’s market deserves a clear read, and you will get it here. This page serves two purposes: it is the Georgetown TX September 2025 Market Update and it doubles as your Georgetown TX September 2025 Housing Market Report. I wrote it for clients who want specifics, not filler. You will find the most recent numbers you provided, paired with practical strategy, and you will see how to act on them with confidence.

The headline you can use today

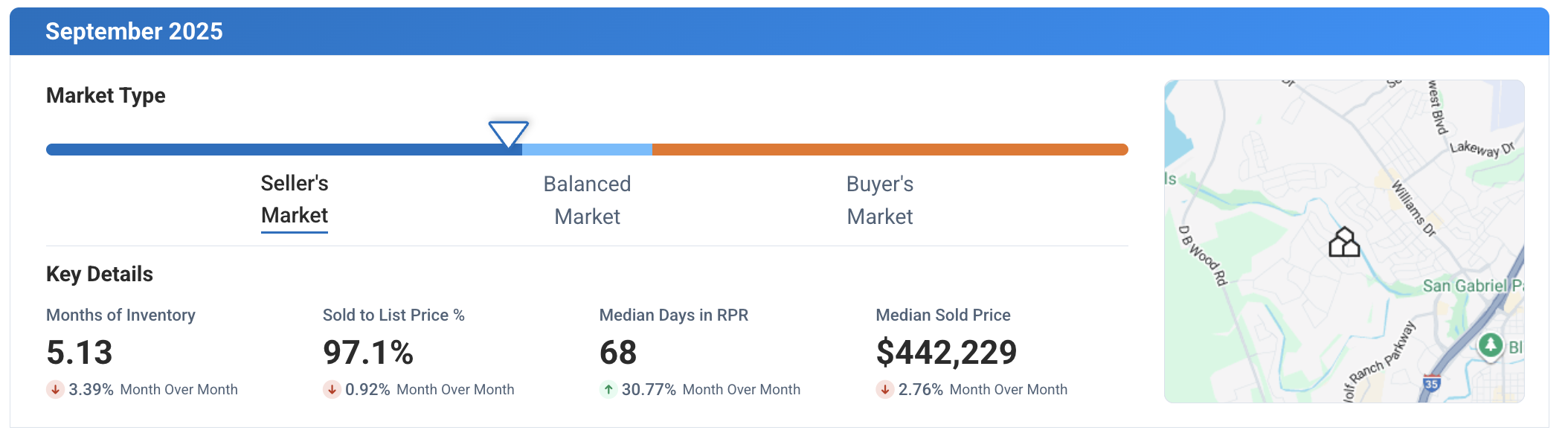

The market sits at 5.13 months of inventory. That single figure tells a big story. It signals a balanced environment where neither side dominates. Buyers and sellers negotiate with substance, and pricing holds within a sensible range. Decisions still matter a great deal, and the right setup decides who wins the conversation at the table.

Inventory trends add depth to the headline. Short term, inventory declined by 3 percent. Long term, inventory rose by 15 percent. Those two movements point to a market that can tighten in spurts, then expand as new options return. Both sides should plan accordingly. We will unpack how to do that in the sections below.

Homes sell for 97 percent of list price on average. That ratio puts real brackets around negotiation. It rewards accurate pricing and clean presentation, and it gives buyers a chance to secure value without expecting an unrealistic discount. Median days on market sits at 68. That pace allows time to position, test, and adjust, yet it still favors those who prepare well on day one.

The median sold price lands at 442,229. Treat that number as a budgeting anchor and a valuation checkpoint. It will not predict every outcome, but it frames expectations clearly. With those data points in hand, let us go from numbers to action.

How to read a balanced market with precision

Balanced conditions require discipline. Sellers must price to the lane the market rewards today, not last year. Buyers must act quickly on well prepared listings, while remaining selective on properties that miss the mark. In Georgetown, 5.13 months of inventory means your success depends on execution across pricing, preparation, and timing. You do not need perfection, you need a plan that removes guesswork and reduces friction.

When the short term inventory dips by 3 percent, urgency can tick up for a few weeks. Good listings get more attention, and the traffic clusters. When the long term trend shows a 15 percent rise, choice broadens and leverage can inch toward buyers who wait for fit and value. The lesson is simple. Time your move with the shape of inventory, not the headlines of the month. We watch the curve, then we place your strategy where the curve is headed.

Inventory in practice, what 5.13 months means for a seller

At 5.13 months, you do not price for a bidding frenzy. You price to earn strong showings and a clean offer. A balanced market rewards a precise list price that aligns with condition and competition within a half mile and the most recent thirty to sixty days. Price above that band and days on market stretch. Price within that band and your probability of securing 97 percent of list, plus favorable terms, rises sharply.

The 3 percent short term inventory drop invites a seller to list with confidence when your prep is complete. It is not permission to overreach. The 15 percent long term rise reminds you to protect the first impression. If fresh competition arrives two weeks after launch, your listing should already be the benchmark. When we manage that sequence, you capture attention early, you hold your ground during negotiations, and you keep the calendar on your side.

How buyers should work the same numbers

Buyers have leverage when they prepare. In a 5.13 month market, you can write an offer that reflects value without scaring a seller away. The 97 percent sale to list ratio tells you the middle of the field. We target well prepared homes that match your must haves, then we position your terms to beat similar buyers by being ready, responsive, and clean. We also scan for listings that overshoot value. Those properties often become opportunities after two or three weeks.

The 68 day median days on market gives you time to analyze, yet time can also tempt hesitation. The best use of that time is deliberate discovery. We will inspect the market segment, we will benchmark condition, and we will model a likely outcome before you tour. When a listing fits, you move with intent. When it does not, you skip it and protect your energy.

Price, pace, and probability

The median sold price of 442,229 offers a reality check. It anchors your budget and flags the level where most buyers and sellers meet. It is not a cap or a floor for your situation. It is a compass. By pairing that number with the local comps that match your property type, we can set a price to win, or draft an offer that respects value while preserving your cash for improvements that matter.

The 68 day median tells you something else. Markets that move at this speed reward listings with excellent presentation in the first ten days. They also reward buyers who bring certainty to the table with clean timelines and strong communication. Certainty becomes currency. You can convert it into a better price or into better terms, sometimes both.

Your step by step plan for a Georgetown seller

Start by pricing within a narrow band that reconciles condition, nearby competition, and the most recent accepted offers. Present like it counts, because it does. In week one, you want to be easy to show, visually tight, and priced to invite. The goal is to earn offers that land near that 97 percent band, with terms that protect your net and your timeline.

Use the 3 percent short term inventory dip to your advantage. Launch when the calendar lines up with fresh buyer energy, not against it. Keep your showing windows flexible. In a balanced market, friction costs real money. If offers arrive slightly below ask, judge them against the data rather than emotion. At the 5.13 month mark, smart counteroffers seal deals. Overreactions cause stalls that invite new competition.

In week three and week four, evaluate signal strength. If you see showings without second looks, fix the gap that buyers notice but do not say out loud. If you see second looks without offers, adjust your price by a small, strategic amount that resets attention. These moves keep you inside the market conversation, and they prevent days on market from becoming your headline.

Your step by step plan for a Georgetown buyer

Work from the budget up. The 442,229 median sold price frames what the market tends to reward. If you aim higher, your proof of value must be sharper. If you aim lower, your expectations for condition must adjust. Before you tour, we will define your must haves and your nice to haves, then we will calibrate the spread between the two.

Use the 5.13 months of inventory to create choice without delay. You have options, yet the best homes will not wait until day 68. Target listings with complete disclosures, strong preparation, and clear photography. Those sellers signal seriousness. When you find a match, use the 97 percent ratio as a starting lane, then negotiate with terms that mean something to the seller, like clean timelines and limited contingencies where your risk remains acceptable.

If the short term inventory dip tightens your segment, look for overlooked value. Listings that launched too high will often drift into your lane after two weeks. Track them, then reenter with a fair offer that respects the seller’s effort while protecting your position. When long term inventory builds again, widen your search one notch to capture new entrants that check more boxes.

Timing your move without guessing

Sell first or buy first, that is the classic question. In Georgetown, the 68 day median gives us a workable window to coordinate both successfully. If you must sell to buy, we can prepare your listing to move within that market pace while lining up your purchase search in the background. If you can buy without selling first, we can act fast on a new listing that fits, then backfill your sale with a pricing and launch plan that attracts attention quickly.

The short term 3 percent dip invites a more aggressive launch for sellers who are move in ready. The long term 15 percent rise tells buyers that patience can be rewarded, as more options typically surface over the next cycle. Neither signal stands alone. We marry them to your timeline and your financing, then we pick the lane that keeps control on your side.

How the Georgetown TX September 2025 Market Update guides valuations

Valuation is not a guess, it is a pattern match. We combine 5.13 months of inventory, the 97 percent sale to list ratio, the 68 day median pace, and the 442,229 median price to build a valuation lane for your property or your offer. We then test that lane against the most recent accepted contracts in your micro area. The result is a price and a plan that fit the market you are in, not the one you wish you had.

This approach reduces renegotiation risk and increases the chance of a smooth close. Appraisers work from similar patterns, and we aim to be on the right side of those patterns from day one. That is how you protect both time and money.

How the Georgetown TX September 2025 Housing Market Report supports negotiation

Numbers create context, and context creates confidence. When you sit at the table with a clear read on 5.13 months of inventory, you negotiate with a steady hand. When you understand the 97 percent ratio, you know which offers are serious and which miss the zone. When you remember that the median days on market is 68, you keep perspective during week two and week three. These details help you decide when to push and when to sign.

I use these benchmarks to craft offers and counteroffers that feel reasonable to the other side while defending your goals. Reasonable does not mean soft. It means strategic. We pick battles that win outcomes, not arguments.

Why hire Robbie English for this market

![]() You want an advocate who treats your move like a mission. I am Robbie English, Broker and REALTOR at Uncommon Realty. I bring decades of experience that you can put to your competitive advantage. I am a national real estate speaker and a real estate instructor who teaches agents nationwide the ins and outs of real estate. I translate that depth into practical steps that move you from data to results in Georgetown.

You want an advocate who treats your move like a mission. I am Robbie English, Broker and REALTOR at Uncommon Realty. I bring decades of experience that you can put to your competitive advantage. I am a national real estate speaker and a real estate instructor who teaches agents nationwide the ins and outs of real estate. I translate that depth into practical steps that move you from data to results in Georgetown.

My team and I focus on expert guidance. We prepare, price, position, and negotiate with intention. We study inventory at the block level and we watch shifts across time, then we fit your strategy to the facts. I have strategically worked to master real estate for the betterment of my clients, and I would welcome the chance to prove it to you on your timeline.

What sets our approach apart in Georgetown

First, we build your plan around the real numbers you see here. We do not chase trends, we read the tape. Second, we run a process that makes your property easy to buy or your offer easy to accept. Friction kills momentum. We remove it. Third, we communicate with clarity so that you understand what is happening, what it means, and what happens next.

For sellers, that means a launch calibrated to 5.13 months of inventory, with pricing that earns attention and negotiation that holds your net. For buyers, that means a search that finds fit first, then secures it with terms that rise above competing offers without overspending. In both cases, we keep your stress down by making each step clear and predictable.

Case paths that match today’s data

If you are selling a well updated home in a sought after pocket, the 3 percent short term inventory dip can help you. We will plan a release that aligns with peak weekly traffic, then we will price to invite early action. The goal is to secure an offer near that 97 percent lane, with a timeline that meets your plans.

If you are buying within the median price band, the 15 percent long term inventory rise can increase your choice set. We will position you to strike when the right home appears, and we will keep two to three viable backups in view. When the perfect fit lands, you will be ready to write, and you will be comfortable with the number because we did the work up front.

If you are moving up or moving down, the 68 day median pace gives us room to coordinate both sides. We will build your contingency and your dates to mesh, so your move feels like a sequence, not a scramble.

Your Georgetown TX September 2025 Market Update, used the right way

Data earns its keep when you turn it into moves that work. In this Georgetown TX September 2025 Market Update, you have the core figures that define the current landscape, and you have a playbook to use them. The same is true for this Georgetown TX September 2025 Housing Market Report. Use it to decide when to list, how to price, how to negotiate, and where to set expectations. Then partner with a team that can execute the plan without drama.

The human side of a data driven process

Markets change changing the Georgetown TX September 2025 Housing Market Report. People have goals, constraints, and timelines. My job is to bridge those two realities with a process that protects you. I will speak plainly, I will show my work, and I will help you move from one step to the next without confusion. When surprises appear, we will meet them with preparation, not panic. That is how we keep outcomes on track.

Why choosing the right professional matters

Experience compresses time. I have seen many markets, and I have guided clients through rising inventory, tightening supply, and balanced seasons like this one. As a national speaker and instructor, I train other agents on exactly these topics. That experience becomes your edge in Georgetown. It shows up in your pricing, in your negotiation posture, and in the way we manage each date and deliverable on the calendar.

You could work with any agent. You should work with the one who can show you the path, then walk it with you. Choose the professional who treats your objectives as the project plan. That is how you get from intention to signature.

How we will start, step one to step done

If you plan to sell, we will begin with a property review that pins down condition, competition, and likely value. We will set a list price that aims at a strong contract within the market’s 68 day rhythm, and we will define a launch schedule that benefits from any short term inventory tightening. If you plan to buy, we will begin with a budget and segment analysis that matches your criteria to the realities of the 5.13 month market, then we will set your offer posture to compete smartly around the 97 percent lane.

From there, communication is frequent and direct. You will always know where we stand, what is next, and why it matters. That is how we keep leverage on your side from the first conversation to the closing table.

Final word, clear and actionable

Georgetown rewards smart planning right now. The market sits at 5.13 months of inventory. Short term inventory tightened by 3 percent. Long term inventory rose by 15 percent. Homes sell for about 97 percent of asking. The median days on market is 68. The median sold price is 442,229. Those facts are your compass. Use them with intention, then pair them with a professional who will execute with care.

This page exists to serve you as a Georgetown TX September 2025 Market Update, and it also stands as your Georgetown TX September 2025 Housing Market Report. If you are ready to act, I am ready to help. I am Robbie English, Broker and REALTOR at Uncommon Realty, and my team provides expert guidance to clients who want clarity, speed, and strong results. I bring decades of experience to your side, and I will put that experience to your competitive advantage. I am a national real estate speaker and instructor who teaches many agents nationwide, and I have strategically worked to master real estate for the betterment of my clients. When you want to win in Georgetown, work with the professional who makes the market work for you.

Leave a Reply