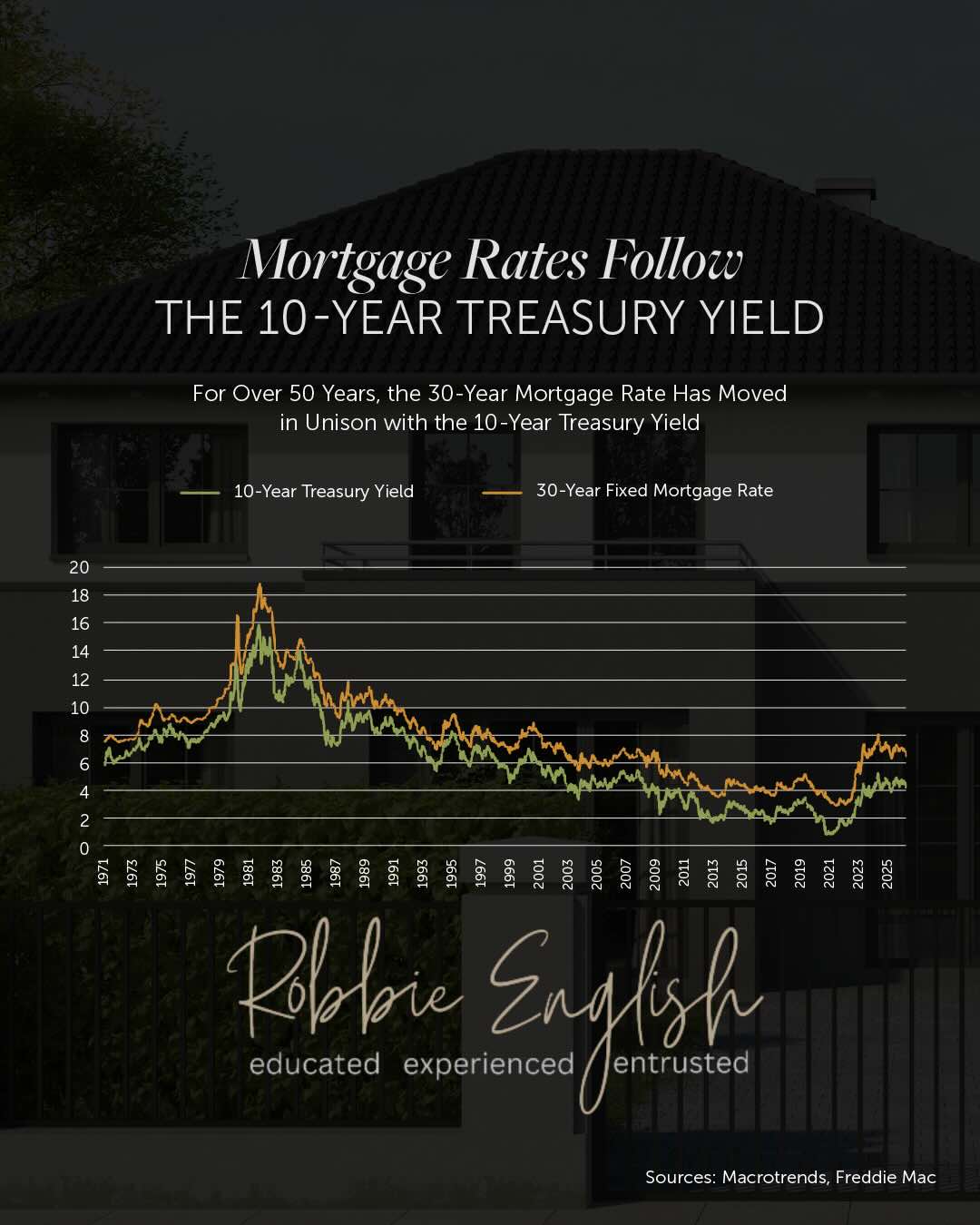

Understanding why mortgage rates follow the 10-year Treasury yield is one of the smartest financial insights you can have when buying or selling a home. For over 50 years, these two have moved in tandem. When one rises, the other typically follows suit. It’s not random, and it’s not just about the Federal Reserve. The connection between mortgage rates and the 10-year Treasury yield runs deep, and if you’re keeping an eye on where rates might head next, this is the metric to watch.

The good news: that gap between mortgage rates and the 10-year Treasury yield is finally narrowing. Experts predict that as the yield comes down in the coming months, mortgage rates may follow, bringing welcome relief to homebuyers waiting for the right moment to make a move.

And when you’re trying to make sense of what all this means for you and your real estate goals, that’s where I come in. I’m Robbie English, Broker with Uncommon Realty, and my job is to help you read between the lines, interpret market signals like the 10-year Treasury yield, and position you for success whether you’re buying, selling, or investing.

TLDR: Mortgage Rates Follow the 10-Year Treasury Yield

- Mortgage rates follow the 10-year Treasury yield closely over time.

- When the 10-year yield drops, mortgage rates often come down too.

- The gap between them is narrowing, signaling potential rate relief.

- Watching the Treasury yield helps predict rate movement better than headlines.

- Robbie English tracks these shifts daily to help clients act strategically.

Why Mortgage Rates Follow the 10-Year Treasury Yield

To understand the rhythm of mortgage rates, you need to look beyond headlines and economic soundbites. Mortgage lenders set their rates based on what investors expect to earn in return for lending money over time. The 10-year Treasury yield represents that expectation. It’s seen as one of the safest investments available, backed by the U.S. government.

When investors feel uncertain about the economy, they move their money into Treasuries, which drives yields down. Conversely, when confidence rises and investors shift toward riskier assets, Treasury yields increase. Mortgage rates, which are priced similarly to long-term bonds, tend to follow that same motion. It’s like a shadow relationship — steady, predictable, and powerful.

Over the decades, data shows a near lockstep relationship between the two. Mortgage rates typically sit about 1.5 to 2 percentage points above the 10-year yield, covering the risk and costs associated with lending to homeowners rather than the government. That spread, however, can widen or shrink depending on market volatility, inflation expectations, and investor appetite.

Why the Spread Between Mortgage Rates and the 10-Year Treasury Yield Matters

When the economy faces uncertainty — say, inflation, bank stress, or geopolitical tension — investors demand higher returns to take on the perceived risk of mortgages. This causes the spread to widen.

Today, that spread has been unusually large, meaning mortgage rates have stayed higher than what Treasury yields alone might predict. But that’s starting to change. As economic pressures ease, that spread is shrinking, opening the door for mortgage rates to come down even if the Federal Reserve doesn’t slash benchmark rates immediately.

Understanding this connection gives homebuyers and sellers a clearer picture of timing. When you see the yield on the 10-year Treasury slipping, that’s a sign mortgage rates may soon follow. It’s one of the most reliable indicators we have.

What the 10-Year Treasury Yield Means for Homebuyers

Let’s make it simple. When you buy a home, your mortgage rate directly affects how much house you can afford. A small rate drop can mean hundreds of dollars in monthly savings and tens of thousands over the life of your loan.

Let’s make it simple. When you buy a home, your mortgage rate directly affects how much house you can afford. A small rate drop can mean hundreds of dollars in monthly savings and tens of thousands over the life of your loan.

By watching the 10-year Treasury yield, you can anticipate when rates may trend lower — often before lenders formally adjust their pricing. This insight can be invaluable if you’re trying to decide whether to lock your rate or wait a little longer.

I’ve seen buyers who understood this connection save significant amounts because they timed their decisions around these trends. Knowledge, in this case, really does pay.

The Emotional Side of Interest Rates

It’s easy to get caught up in the emotional rollercoaster of rate headlines. One week, they’re up; the next, they’re supposedly down again. But reacting to short-term noise can cost you long-term opportunity.

When you focus on the fundamentals — like the 10-year Treasury yield — you’re not guessing; you’re following a proven economic relationship that helps you make more confident decisions. Whether you’re refinancing, upgrading, or purchasing your first home, patience combined with insight leads to smarter moves.

This is why having a trusted professional who understands both the data and the emotions behind it is crucial. That’s where I step in to help bridge that gap between information and action.

How Robbie English Uses Data to Your Advantage

![]() At Uncommon Realty, I make it my job to interpret the complex signals of the real estate and lending markets in a way that helps my clients act with clarity. I don’t expect you to know the daily movement of Treasury yields, but I watch it for you — and I translate those shifts into actionable strategies.

At Uncommon Realty, I make it my job to interpret the complex signals of the real estate and lending markets in a way that helps my clients act with clarity. I don’t expect you to know the daily movement of Treasury yields, but I watch it for you — and I translate those shifts into actionable strategies.

For example, if I see the yield curve flattening or the 10-year yield beginning to fall, I’ll help you decide whether to start shopping for homes now or to prepare for potential refinancing opportunities down the line. I believe in empowering my clients through context, not confusion.

I also collaborate closely with trusted lenders who monitor these same economic indicators, ensuring you have a full picture when deciding on timing, loan type, and negotiation leverage.

Because understanding that mortgage rates follow the 10-year Treasury yield is only the beginning. Acting on that insight at the right time is where your advantage lies.

What This Means for Home Sellers

You might think that the connection between mortgage rates and Treasury yields only matters for buyers, but sellers should pay attention too.

When rates ease, more buyers enter the market, increasing demand and often shortening days on market. Sellers who list strategically as rates start to come down tend to capture more activity and stronger offers.

By watching this trend and aligning your listing timing with potential rate drops, you can position your property to sell faster and potentially for a higher price. My clients rely on me to interpret these signals so they can plan ahead rather than react after the fact.

The Path Forward: What to Watch Next

So, where do we go from here? Experts predict the 10-year Treasury yield may trend lower as inflation stabilizes and markets adjust to slower growth expectations. If that happens, mortgage rates are likely to follow.

But remember, these changes don’t happen overnight. Markets move in waves, and yields can fluctuate before settling into a new direction. That’s why monitoring trends over weeks, not days, is key.

I stay on top of this data daily so you don’t have to. When new opportunities appear — whether a favorable rate shift, a lender incentive, or a temporary pricing window — I make sure my clients know how to act decisively.

If you’re wondering when the right time to make your move might be, now’s the moment to start the conversation. Understanding the why behind rate movements today will put you in a position of power tomorrow.

Why Working with Robbie English Makes the Difference

Not every real estate professional takes the time to understand financial indicators like the 10-year Treasury yield. But I believe my clients deserve better than generic advice.

I analyze trends, decode data, and translate complex market movements into clear, practical insights you can use. My role is to guide, strategize, and keep you informed — so that when opportunity strikes, you’re ready.

Whether you’re looking to buy a first home, upgrade to a larger space, or invest in property, I tailor my approach to your goals while staying laser-focused on the economic forces shaping your success.

Because at the end of the day, when mortgage rates follow the 10-year Treasury yield, what matters most isn’t just understanding the trend — it’s knowing how to act on it.

How to Take the Next Step

If you’ve been sitting on the sidelines waiting for rates to fall, the narrowing gap between mortgage rates and the 10-year yield is your signal to start planning. Connect with me, and let’s evaluate your timing, financing strategy, and property goals.

I’ll break down the numbers, interpret what’s happening behind the scenes, and ensure you’re ready when the right moment arrives.

When markets shift, information becomes your best asset — and that’s what I deliver.

Final Thoughts

Markets change, but fundamentals remain. The reason mortgage rates follow the 10-year Treasury yield is simple: both are reflections of long-term investor confidence and economic expectations.

You can’t control the market, but you can understand it. And when you have someone like me tracking the data, explaining the movement, and positioning your strategy around it, you’re no longer reacting to change — you’re leveraging it.

If you’re ready to take the guesswork out of your next real estate move, I’m here to guide you through every step. Let’s talk about what the market’s telling us today, and how to use that insight to reach your goals tomorrow with Uncommon Realty.

Leave a Reply