Buying a home is one of the most powerful ways to build long-term stability and wealth, yet many people hesitate because of student loans. The phrase “don’t let student loans hold you back from homeownership” isn’t just a catchy idea—it’s a reminder that your financial goals and education can work together. At Uncommon Realty, I’m Robbie English, Broker and REALTOR, and I’ve helped countless clients overcome this very concern. With the right strategy, preparation, and guidance, owning a home is closer than you think.

TLDR: Don’t Let Student Loans Hold You Back from Homeownership

- Student loans don’t automatically disqualify you from buying a home.

- Your debt-to-income ratio and payment history matter more than the loan itself.

- Strong credit, steady income, and smart planning can make homeownership achievable.

- Partnering with an expert like Robbie English at Uncommon Realty gives you a clear path forward.

- Don’t wait until your loans are gone—start exploring what’s possible today.

Why You Shouldn’t Wait to Pursue Homeownership

Too many potential buyers believe they must eliminate all their student debt before buying a home. That’s simply not true. Mortgage lenders look at the full picture: your income, debt ratio, credit health, and consistency. If you’ve been paying your student loans responsibly, that track record actually works in your favor. It shows lenders that you can handle long-term financial commitments, which is exactly what they want to see.

Waiting too long to buy could cost you more in the long run. Home values tend to increase over time, and interest rates fluctuate. When you hold off unnecessarily, you could end up spending more later for the same property. The key is understanding where you stand financially right now. That’s where my team at Uncommon Realty steps in to help. We don’t just open doors to homes—we open doors to opportunity.

Understanding How Student Loans Affect Home Loans

When you apply for a mortgage, your student loan balance isn’t the only number that matters. Lenders focus on your debt-to-income ratio, or DTI. This ratio compares how much you owe each month to how much you earn. The lower that percentage, the stronger your application. But even if your DTI is higher because of student loans, certain programs make it easier to qualify than you might think.

For example, lenders may use your actual monthly student loan payment rather than a projected one. That often works in your favor if you’re on an income-driven repayment plan. If your payments are current and manageable, you could very well qualify for a home loan even before paying off the balance. The message is clear: don’t let student loans hold you back from homeownership. With the right financial snapshot and preparation, your dream of buying a home can happen sooner than you think.

How to Strengthen Your Buying Position

There are practical ways to improve your chances of getting approved for a mortgage while managing student debt. Start with your credit score. Pay bills on time, avoid unnecessary new debt, and reduce credit card balances. These small steps create a big impact. Then, focus on saving for a down payment. Even a modest amount can improve your loan terms and lower your monthly costs.

A steady job history also gives lenders confidence. The more consistent your income appears, the better your profile. When you combine solid financial habits with professional guidance, you put yourself in a position of strength. My role as your Broker and REALTOR is to help you understand the fine print, prepare for lender expectations, and navigate the process with ease. I’ve seen countless clients surprise themselves by qualifying for homes they didn’t think they could afford.

Why Working with the Right Agent Makes All the Difference

Real estate isn’t just about transactions—it’s about strategies, timing, and execution. You need an advocate who knows how to navigate complex lending conditions, especially when student debt is involved. I’ve spent decades mastering the craft of real estate so my clients don’t have to learn it the hard way. My approach is strategic and intentional, built on data, relationships, and experience.

As a national real estate speaker and instructor, I’ve trained agents across the country on how to handle situations just like this. That means my clients benefit from an insider’s understanding of how lenders, appraisers, and markets operate together. When it comes to buying a home with student loans, expertise like that is invaluable. It can be the difference between hearing “no” and closing on your dream property.

The Real Power of Perspective

Owning a home while still repaying student loans is absolutely possible, but it requires the right mindset. Instead of viewing your loans as a barrier, consider them part of your financial story. They’re proof of your commitment to growth, education, and progress—all traits that serve you well as a homeowner. When you take control of your finances and work with an experienced professional, your goals move from distant dreams to achievable plans.

At Uncommon Realty, we look at every client individually. There’s no one-size-fits-all solution because your journey is unique. I’ll take the time to review your full financial situation, connect you with trusted lenders, and create a clear roadmap toward homeownership. Together, we’ll outline a strategy that aligns with your income, savings, and loan repayment schedule so you can take confident steps toward your new home.

When to Start the Process

If you’ve been waiting for the perfect moment, you might be waiting too long. The best time to start exploring your options is before you think you’re ready. Early planning gives you time to correct issues, improve credit, or save strategically. Even if you’re a year or two away from buying, a consultation now could save you thousands later.

I’ve seen clients who initially doubted they could qualify for a mortgage go on to become proud homeowners within months. The process begins with awareness. Once you know what lenders look for and how to present your financial strengths, everything changes. You shift from uncertainty to confidence, and that’s exactly what makes you a strong buyer.

How Robbie English and Uncommon Realty Make It Easier

![]() Choosing the right real estate professional isn’t just about finding someone with experience. It’s about finding someone who understands how to leverage that experience for your benefit. I’m Robbie English, Broker and REALTOR at Uncommon Realty, and my team specializes in guiding buyers through complex financial landscapes, including those with student loan obligations. We’ve helped buyers navigate every obstacle imaginable and turn perceived roadblocks into stepping stones.

Choosing the right real estate professional isn’t just about finding someone with experience. It’s about finding someone who understands how to leverage that experience for your benefit. I’m Robbie English, Broker and REALTOR at Uncommon Realty, and my team specializes in guiding buyers through complex financial landscapes, including those with student loan obligations. We’ve helped buyers navigate every obstacle imaginable and turn perceived roadblocks into stepping stones.

Our approach focuses on education and empowerment. We walk you through the entire process, explain every document, and ensure you never feel overwhelmed or uncertain. We also help sellers understand how to attract qualified buyers—even those balancing student debt—by pricing strategically and marketing intelligently. Whether you’re buying or selling, you deserve representation that is both knowledgeable and proactive.

Common Myths About Buying a Home with Student Debt

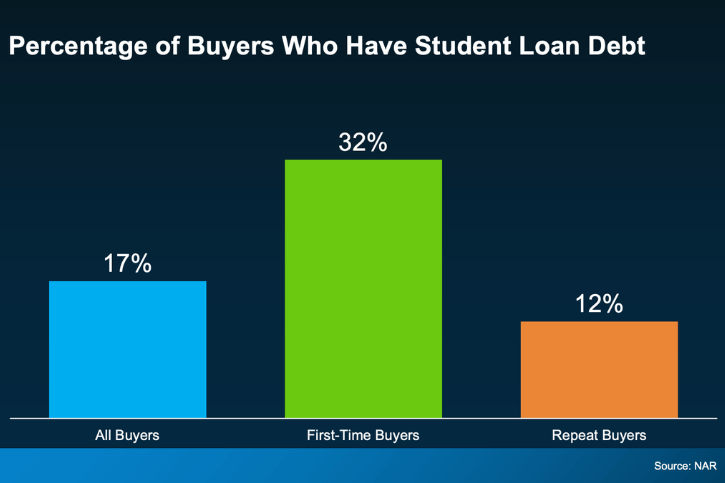

One of the biggest misconceptions is that lenders automatically reject buyers with student loans. That’s not the case. In fact, many homeowners today carry some level of student debt. What matters more is how you manage that debt. Consistent payments and low revolving balances show financial discipline, which lenders appreciate.

Another myth is that you can’t afford a down payment while paying off loans. Many buyers use creative savings strategies, tax refunds, or employer benefits to fund their down payment. There are also assistance programs that can help bridge the gap. A good agent doesn’t just show you homes—they show you possibilities. My job is to connect you with options you may not even realize exist.

A Real Strategy, Not Just Advice

Buying a home is more than signing a contract; it’s about positioning yourself for success. I don’t believe in cookie-cutter advice. Every client’s financial and personal story is unique. That’s why we craft customized strategies that align with your short-term and long-term goals. My team and I analyze your situation, outline achievable steps, and coordinate with trusted lenders who understand nontraditional borrower profiles.

When you partner with Uncommon Realty, you gain more than an agent—you gain a strategic ally. We help you see past the obstacles and focus on solutions. Whether you need to reduce debt, consolidate payments, or adjust your credit mix, we’ll work with you to make that happen. We turn “someday” into “soon.”

The Emotional Side of Buying with Student Loans

Let’s talk about the emotional side for a moment. Carrying student debt can feel heavy, even discouraging at times. It’s easy to believe that big financial moves like buying a home are out of reach. But they’re not. When you break the process down step by step, it becomes manageable—and empowering. Every client I’ve worked with who thought they couldn’t qualify ended up realizing that they could, and the joy that follows that realization is incredible.

The key is clarity. When you understand what lenders evaluate and how to optimize your profile, the mystery disappears. That’s where I come in. My goal is to simplify the complex, remove the guesswork, and give you the confidence to move forward. Your student loans are part of your financial picture, but they don’t define your limits.

Planning for the Future

Your education was an investment in yourself. Buying a home is an investment in your future. The two can coexist. The smartest buyers look at both and design a plan that supports each goal. Maybe that means paying a bit more on your loans each month or saving strategically for a down payment. It’s about balance, not perfection.

At Uncommon Realty, we help clients think long-term. I teach other agents nationwide how to combine technical knowledge with real-world understanding to better serve their clients. When you work with me, you’re working with someone who’s trained others on these very principles. That depth of experience becomes your competitive edge in a market where preparation and timing are everything.

Why You Should Choose Robbie English

There’s no shortage of real estate agents, but few bring the depth of knowledge, teaching experience, and strategy that I do. As a Broker and REALTOR, I’ve spent decades refining my approach to ensure that my clients always come out ahead. My national speaking and teaching background means that the same insights I share with other professionals are the same ones I use to guide you.

I don’t rely on luck or chance—I rely on strategy. My clients benefit from tested systems, insider market understanding, and tailored advice designed to turn goals into results. When you’re trying to buy a home while managing student debt, that level of precision matters. You need someone who can anticipate obstacles before they arise and turn them into opportunities for success.

Putting Your Education to Work for You

Education empowered you to pursue your dreams, and now it can empower your path to homeownership. Rather than viewing your student loans as a setback, see them as proof of your dedication and resilience. Those same traits will help you navigate the home-buying journey. My job is to help translate your financial situation into a story lenders understand and respect.

When you work with Uncommon Realty, you’re not just buying a home—you’re investing in a process built on expertise, trust, and results. Every conversation, every showing, every negotiation is guided by strategy. I don’t just help you buy property; I help you buy wisely.

Taking the First Step Toward Your Future

The idea of owning a home while still paying off student loans can feel intimidating, but the truth is, you can do it. The most important thing is to start. Reach out, have the conversation, and let’s look at where you stand. I’ll walk you through your financial picture, connect you with knowledgeable lenders, and outline what it takes to make your dream possible.

Remember, don’t let student loans hold you back from homeownership. With the right guidance, preparation, and partnership, you can step confidently into your future. I’ve seen it happen time and again, and I’d love to help it happen for you.

The Bottom Line

Student loans don’t define your financial potential. They’re simply one part of your story, and they don’t have to keep you from owning a home. When you work with an experienced professional who knows how to navigate the process, you can turn what feels like an obstacle into a path forward. I’m Robbie English, Broker and REALTOR at Uncommon Realty, and my team and I specialize in helping clients like you reach their real estate goals with confidence. Whether you’re buying your first home or planning your next move, we’ll guide you every step of the way. So, take that first step today—your homeownership journey is waiting.

Thank you, Robbie, for sharing this perspective. Student loans feel overwhelming for a lot of people, and your post does a great job cutting through the fear and misinformation with clear, practical insight. I really appreciate how you explain the bigger picture and show that homeownership can still be within reach with the right guidance and planning. This is encouraging, grounded advice that a lot of buyers need to hear right now.